Why it Makes Sense to Carry as a Seller

So, you want to sell your business. And you hate the idea of seller financing or holding a note for the buyer. Or you might have heard terms like “seller carry” or “seller carryback” floating around, and you don’t even know what they mean. And no, this doesn’t look anything like picture above.

Allow me to introduce you to the elegant financial solution of seller financing and why you might want to warm up to it.

So, what is seller financing anyway?

Simply put, seller financing means that the owner of a business offers a prospective buyer the option to finance a portion of the business’s sale price. You might also hear it called “seller carry” or “seller carryback.”

In this type of transaction, the seller is acting as a bank and will receive interest payments over the term of the loan.

Seller financing is common in situations when the business is big enough to make a cash sale for the buyer difficult (over $100K), but too small for mid-market venture capitalists (below $5M). You would also see seller financing when the business does not appeal to traditional lenders for various reasons.

How does seller financing work?

The simplest way to think about seller financing for acquiring a business is to regard the current business owner as lender. In most seller financing business agreements, the owner agrees to strike a deal with the buyer in which he or she extends a loan for a portion of the sale price. As a rule of the thumb, sellers will usually agree to finance 15 – 30% of the sale price. Many do more than that, or even add an earnout to sweeten the deal. It all depends on the situation.

The buyer agrees to pay back this loan over a set term with an interest rate which is typically at or below bank prime rates, and the terms of the seller note are usually similar to that of a bank.

The buyer might pay the rest of the purchase price through some combination of a cash down payment, bank loan, and/or earn out.

Many do more than that. It all depends on the situation because each transaction is unique.

Let’s look at an example to bring this concept to life.

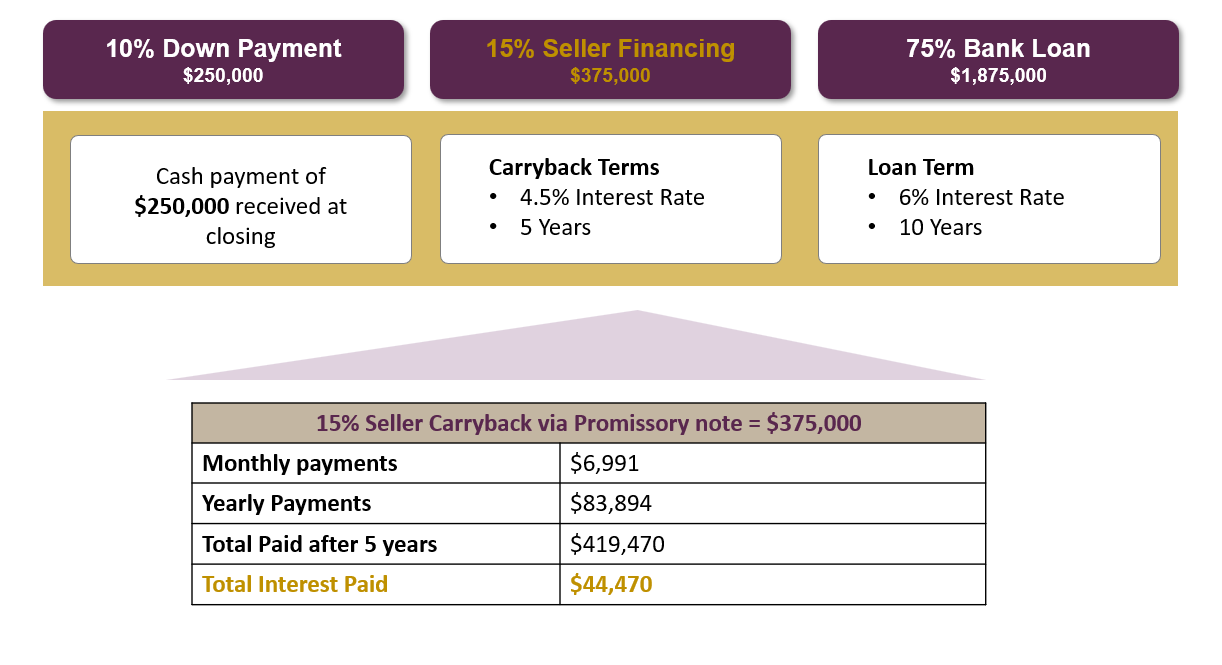

Imagine that you want to sell your business for $2.5M. The transaction might be structured as a 10% down from the buyer, 15% seller carry, and 75% bank loan.

The seller note might run for 5 years at a 4.5% interest rate and the bank note might run for 10 years at a 6% interest rate.

Monthly payments are the norm and usually start 30 days from the date of sale unless other arrangements are made.

Here is what the seller financing terms might look like with a sale price of $2,500,000.

Here’s why you might want to finance the sale of your business.

Sellers are usually reluctant to offer seller financing because of the fear of the unknown. Despite the advantages of playing bank, it is uncomfortable to be in this role because there are some risks involved, like buyer default.

Hopefully, the five main reasons below will give you persuasive reasoning to the upsides to seller carry and why you might want to consider it in the sale of your business.

1. Higher purchase price:

Some surveys have shown that the average sale price of a business, where the seller helped carry financing, is 15% higher. Now that should motivate you!

Because a buyer avoids some of the high closing cost tied with only traditional forms of financing, they are more willing to agree to a higher sale price. In addition, the potential of earning accrued interest is a significant source of capital for the seller over the term of the loan.

I know you might prefer to have all of the money on the day the deal closes, but it is definitely worthwhile to exchange cash up front for a larger return over time.

2. Increase your pool of buyers:

This might actually be the reason why you get a higher price. With a carryback deal, you increase your pool of buyers because buyers are usually focused on achieving a purchase on terms that allow them to buy with as little ‘cash in’ as possible, even if costs are higher in the long run, especially now when cash is cheap.

And just like that, with seller financing, you have an opportunity to beat the competition for buyers as they will need less cash upfront to complete the purchase.

3. Tax Advantage:

Whenever you talk about interest and there is interest on a promissory note, there is always potential for favorable tax consequences of getting paid over time rather than upfront. Because you are payed in installments versus lump sum, you can spread out the tax hit over many years.

4. Buyer Confidence:

The act of agreeing to finance your business is a direct statement of trust in your business and its ability to be successful in the future. This is a very telling point for the buyer because it acts like a bond for performance to assure the buyer that the seller will live up to the promises made during the sale. Most importantly, you are in essence saying, “I am willing to bet on the future of my business.” And please tell me, which buyer doesn’t want that for their investment? No buyer wants the promise of a white picket fence only to realize that the house is infested with mold!

5. Friendlier Bank Lenders:

In the scenario where the buyer needs additional financing through a bank loan, seller financing makes the bank more likely to extend the loan to the buyer, because it boils down to trust again.

There’s nothing like putting your money where your mouth is and, by carrying some of the purchase price, you are letting the bank know that you have vested interest in the deal and are ensuring the continued success of your business. Besides, this business might have been your life work! Who else is more qualified than you to select a buyer that would continue your legacy?

Moreover, although the pandemic has driven interest rates to rock bottom levels, which technically means that cash is cheap and there has hardly been a better time to burrow, loans are harder to get! Banks are getting more cautious, having more stringent standards and asking more questions to borrowers.

In that light, agreeing to seller financing is like giving your buyer a vote of confidence which would make the bank more likely to approve a loan.

But with every deal structure, there are always some pitfalls.

If you decide to go with seller financing, you want to make sure you are as secure as possible in the promissory note. If the buyer has other financing, and they often will, it may not be possible to secure the note by tying the payment of the loan to assets. Here are a few things that are helpful to do:

- Conduct your due diligence on the buyer to assess their creditworthiness.

- Definitely take a look at a buyer’s credit report. Also ask for financial documentation and any other documentation necessary to convince you that the buyer can deliver on the agreed upon terms.

So, what's next?

I know that often sellers want no part of seller financing. But you’ve got to realize it’s not just a give, there’s a take here too.

All I am saying is don’t categorically write off seller financing or look at it as a last resort for selling your business, because it could make a ton of sense to help you receive your desired asking price by deepening the pool of potential buyers at a higher price tag.

While you might not receive a large cash payment upfront, you will ultimately make more money because of the interest paid.

If you decide including seller financing in the sale your business, never go it alone. It’s recommended that both parties enlist the professional services of an M&A intermediary.

At the Firm Advisors, we can most certainly help you. We are able to boast of an unheard of 98% satisfaction rate, 291 successful businesses sold (and counting), and deep knowledge of a wide variety of industries. Contact us to learn more.

Now I’m curious. If you are thinking about selling your business, are you open to seller financing?

Recent Posts

- Turning Your Passion Into a Career- With Celebrity Astrologer Kyle Thomas

- Using FBI Tactics to Close a Deal

- How to Rest - The Secret to Success

- 3 Ways to Find Hidden Treasures in Your Team

- 3 Ways to Hire Top Talent for Your Open Positions

- Less is More: Growing Your Business

- Reaching for the Mountains: Setting Obtainable Goals

- Stop Waiting and Start Now

- How to Increase Workplace Productivity

- Growth Mindset: Essential in the Workplace

- 3 Ways to Tackle the Summer as a Small Business

- 4 Free Resources for Small Businesses

- Embracing the Unknown in Business

- Setting Healthy Expectations in the Workplace

- Why Effective Communication is Essential in Business

- Remote Work Here to Stay

- Learning From General Mills and Shrimp Tails

- 11 Years of Omaha Magazine’s “Best of B2B”

- Due Diligence: Preparation is Key

- Your Business as a Machine: Exit Planning Is Not Just for Exiting

- 10 Industries That Will See Post-Pandemic Profits

- Self-Care in a Pandemic

- Asset Sale vs. Stock Sale

- 5 Most Influential Women in the US

- Advertising Industry Outlook – Adapting Strategies

- How Important Is Due Diligence?

- 6 Best Christmas Movies of All Time

- Construction Industry Outlook – Remodeling & Renovation

- 4 Upcoming Business Trends of 2021

- Industries Booming During COVID-19

- What Are You Thankful For?

- Let's Talk About Pets

- What Exactly Are the Benefits of an SBA Loan?

- 2020 Industry Highs and Lows

- What the "Big Buyers" Want

- What’s an earnout, and why does Ryan Reynolds have one?

- M&A Advisor or Business Broker?

- How to Sell a Business in 7 Easy* Steps

- The Firm Advisors: #1 in the World -- Again!

- Documentation is Key During This Time

- Small Business Debt Relief Program

- Work On Your Small Business (While You Aren't Working In It)

- Meet the Listing: Body Shop w/ Towing & Auto Repair

- Superstitions and Deal Killers

- Choosing Your Investments: Stock Market vs. Business Purchase

- Video: Deal Education

- Industry Spotlight: Advertising and Marketing

- Meet the Team: The Firm Advisors Office Tour

- Securing Your Business Against Ransomware

- M&A: What's an M, and what's an A?

- Location, Location, Relocation

- $20M in One Month

- Pet Care: A Recession-Proof Industry

- The Firm Named to BBB Honor Roll

- Firm Family Christmas

- Firmgiving 2019

- Cortney Sells on IBBA's Podcast

- The Firm Makes Inc. 5000

- M&A: The Industry Defying Gravity

- Have You Met Makayla?

- Dr. Lemberg's Pathway to Retirement

- Steven Makes His Mark in M&A

- Hot Off the Press - June 2019 Magazine

- All Good Things Take Time

- The Firm June Magazine Release Celebration

- The Firm Feels Good Doing Good

- Corner Kick Spoils our Swan

- Opportunity of the Week: A Business That Brightens Children’s Futures

- Q&A With Cortney: Stock Sale Versus Asset Sale

- The Ins and Outs of Seller Financing

- Preparing for the Perfect Retirement

- The Firm Is Breaking Industry Records & Poised for Growth in 2019

- Simply the Best

- Competitor Analysis, Opportunities Listed

- Dentist to Dreamer - Hard Work Pays Off!

- Kansas City Tech Company Useagility Sells to First Tek

- #FiveinFive

- 8th Year as Omaha's Best Business Brokerage

- Sellers: Why You Should Finance Your Buyers

- Summer Intern 2017 - Ameya Shelby

- Industry Forecast: Mind the Generational Gap

- 8 Things We Wish Every Business Buyer Knew Before Calling Us

- Selling Your Business: Getting a Proper Business Valuation

- Asset Sales or Stock Sales: Determining the Best for Your Business Transaction

- Why (and How) Business Owners Are Selling in 2017

- The Law of 3's - Choosing the Right Kind of Broker

- A Mutually Beneficial Relationship

- Reaching Out is Key

- Confidential Business Reviews

- A Change of Pace to Business Ownership

- Confidentiality is at the Core of Business

- Moving into the Boardroom

- Buying a Business vs. Starting Your Own

- Bringing Buyers and Sellers Together is Just the Beginning

- Client Interfacing in the Digital Age

- Four Questions Every Buyer Should Ask

- The Firm Outpaces Transaction Totals from Previous Two Years

- Faces of Omaha 2016: Face of Business Brokerages

- The Firm Business Brokerage Set to Double Sales within Seller's Market - MBJ 2014