What Exactly Are the Benefits of an SBA Loan?

So… Everyone is talking about SBA loans. But what exactly are they and what does this mean for you as a current or potential business owner?

SBA stands for Small Business Administration, which is an agency that works with lenders to provide loans to small businesses. The SBA provides an easy way for small businesses to get a loan. Due to the SBA’s set guidelines for loans made by its partnering lenders, community development organizations, and micro-ending institutions, risk is reduced for the lender making it easy to access capital.

Okay, great. I can easily get loan, but how does this loan specifically benefit me as a business owner?

Glad you asked. Here are a couple of highlighted reasons why SBA loans are awesome:

1. A Competitive and Transparent Process

SBA loans have competitive rates and fees comparable to non-guaranteed loans. They can have up to a 25-year term and amount up to $8.5 million and always hold a quick and transparent approval process.

2. Continued Support

Some SBA loans come with continued support and counseling to help you start and run your small business, providing you with an ongoing education.

3. Unique and Flexible Benefits

SBA loans come with benefits unlike other loans. They have lower and flexible down payments, negotiable overhead requirements, and they are cash flow, not collateral, based.

4. Diversified Use

SBA loans can be used for a variety of business needs including:

- Acquisitions

- Expansions

- Partner/manager/employee buyouts

- Real Estate

- Construction

- Debt Refinance

Okay AWESOME. But am I eligible for this type of loan?

Great question.

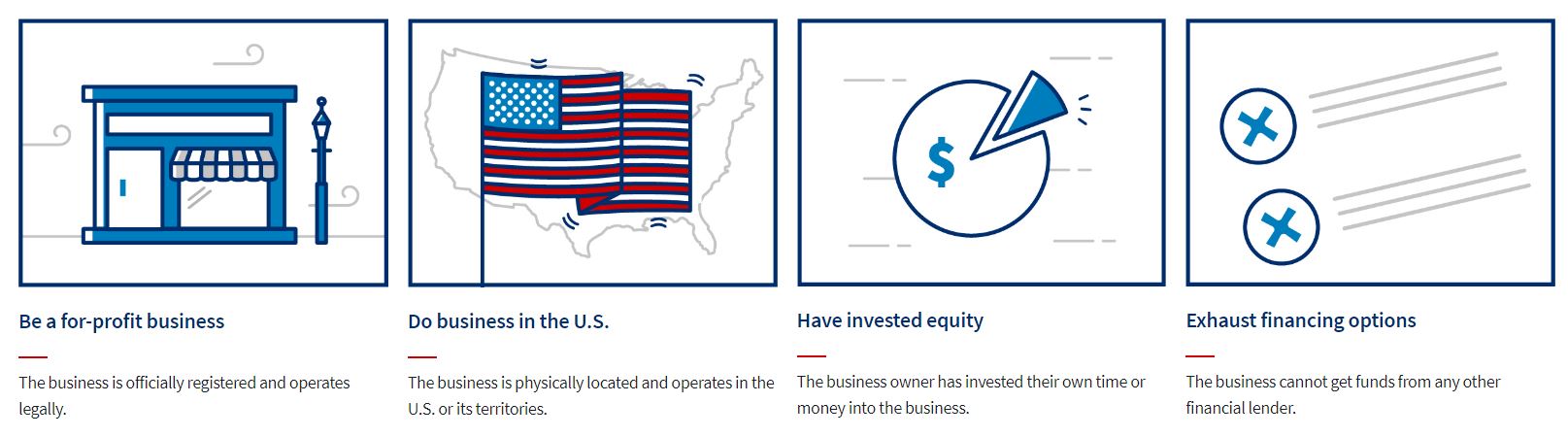

All lenders and loan programs have unique eligibility requirements, but it is generally based on what a business does to receive its income, the character of its ownership and purpose, and its size. And good news. Even those with bad credit may qualify for startup funding. Below are a few general eligibility guidelines:

Does this sound like something that would be helpful to you as a business owner?

Visit the SBA website to find a lender that matches your needs.

Recent Posts

- Turning Your Passion Into a Career- With Celebrity Astrologer Kyle Thomas

- Using FBI Tactics to Close a Deal

- How to Rest - The Secret to Success

- 3 Ways to Find Hidden Treasures in Your Team

- 3 Ways to Hire Top Talent for Your Open Positions

- Less is More: Growing Your Business

- Reaching for the Mountains: Setting Obtainable Goals

- Stop Waiting and Start Now

- How to Increase Workplace Productivity

- Growth Mindset: Essential in the Workplace

- 3 Ways to Tackle the Summer as a Small Business

- 4 Free Resources for Small Businesses

- Embracing the Unknown in Business

- Setting Healthy Expectations in the Workplace

- Why Effective Communication is Essential in Business

- Remote Work Here to Stay

- Learning From General Mills and Shrimp Tails

- 11 Years of Omaha Magazine’s “Best of B2B”

- Due Diligence: Preparation is Key

- Your Business as a Machine: Exit Planning Is Not Just for Exiting

- 10 Industries That Will See Post-Pandemic Profits

- Self-Care in a Pandemic

- Asset Sale vs. Stock Sale

- 5 Most Influential Women in the US

- Advertising Industry Outlook – Adapting Strategies

- How Important Is Due Diligence?

- 6 Best Christmas Movies of All Time

- Construction Industry Outlook – Remodeling & Renovation

- 4 Upcoming Business Trends of 2021

- Industries Booming During COVID-19

- What Are You Thankful For?

- Why it Makes Sense to Carry as a Seller

- Let's Talk About Pets

- 2020 Industry Highs and Lows

- What the "Big Buyers" Want

- What’s an earnout, and why does Ryan Reynolds have one?

- M&A Advisor or Business Broker?

- How to Sell a Business in 7 Easy* Steps

- The Firm Advisors: #1 in the World -- Again!

- Documentation is Key During This Time

- Small Business Debt Relief Program

- Work On Your Small Business (While You Aren't Working In It)

- Meet the Listing: Body Shop w/ Towing & Auto Repair

- Superstitions and Deal Killers

- Choosing Your Investments: Stock Market vs. Business Purchase

- Video: Deal Education

- Industry Spotlight: Advertising and Marketing

- Meet the Team: The Firm Advisors Office Tour

- Securing Your Business Against Ransomware

- M&A: What's an M, and what's an A?

- Location, Location, Relocation

- $20M in One Month

- Pet Care: A Recession-Proof Industry

- The Firm Named to BBB Honor Roll

- Firm Family Christmas

- Firmgiving 2019

- Cortney Sells on IBBA's Podcast

- The Firm Makes Inc. 5000

- M&A: The Industry Defying Gravity

- Have You Met Makayla?

- Dr. Lemberg's Pathway to Retirement

- Steven Makes His Mark in M&A

- Hot Off the Press - June 2019 Magazine

- All Good Things Take Time

- The Firm June Magazine Release Celebration

- The Firm Feels Good Doing Good

- Corner Kick Spoils our Swan

- Opportunity of the Week: A Business That Brightens Children’s Futures

- Q&A With Cortney: Stock Sale Versus Asset Sale

- The Ins and Outs of Seller Financing

- Preparing for the Perfect Retirement

- The Firm Is Breaking Industry Records & Poised for Growth in 2019

- Simply the Best

- Competitor Analysis, Opportunities Listed

- Dentist to Dreamer - Hard Work Pays Off!

- Kansas City Tech Company Useagility Sells to First Tek

- #FiveinFive

- 8th Year as Omaha's Best Business Brokerage

- Sellers: Why You Should Finance Your Buyers

- Summer Intern 2017 - Ameya Shelby

- Industry Forecast: Mind the Generational Gap

- 8 Things We Wish Every Business Buyer Knew Before Calling Us

- Selling Your Business: Getting a Proper Business Valuation

- Asset Sales or Stock Sales: Determining the Best for Your Business Transaction

- Why (and How) Business Owners Are Selling in 2017

- The Law of 3's - Choosing the Right Kind of Broker

- A Mutually Beneficial Relationship

- Reaching Out is Key

- Confidential Business Reviews

- A Change of Pace to Business Ownership

- Confidentiality is at the Core of Business

- Moving into the Boardroom

- Buying a Business vs. Starting Your Own

- Bringing Buyers and Sellers Together is Just the Beginning

- Client Interfacing in the Digital Age

- Four Questions Every Buyer Should Ask

- The Firm Outpaces Transaction Totals from Previous Two Years

- Faces of Omaha 2016: Face of Business Brokerages

- The Firm Business Brokerage Set to Double Sales within Seller's Market - MBJ 2014